The Benefits And Tax Advantages Of Storing

Your Bullion Holdings With IPM Group In

FreePort of Singapore

We very much support and encourage the investor who wishes to pick up personally or take delivery via insured shipment of their precious metal investments. This method works perfectly well for the smaller allocations and certainly contributes to a regular saving scheme plan.

However the difficulty arises when one wishes to make larger investment diversification plans. Taking delivery of kilo gold bars or 1,000 ozs of silver and upwards raises the issue of self storage problems at home, then the considerations you need to make when the time arises to use your holdings as collateral for other investment opportunities or simply sell outright – liquid assets!

We very strongly advise our customers on holding their precious metals outside of the banking system itself (for the many reasons we have stated in previous articles), storing their metals in independent 3rd Party vaulting and safe deposit facilities is very much the only option you should consider.

Safe deposit boxes themselves are limiting as they are usually small and have a maximum weight capacity which invariably is reached very quickly with bullion.

Hence IPM Group have spent a great deal of time arranging facilities to suit the larger diversification investment size that best suits our clients......

Please contact us directly on the minimum size of allocation necessary for allocated storage. For further details on opening a storage account with IPM Group and storage costs, see details here.

FreePort Singapore

The Advantages Should Not Be Under Estimated.

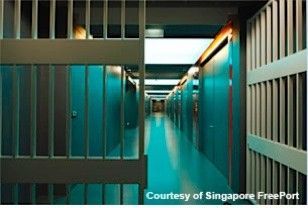

The Singapore FreePort Pte Ltd is a private company whose shareholders include the Singapore National arts Council and the National Heritage Board. It operates a round-the-clock free trade zone modeled after the Swiss Freeports. Its operations are conducted with the support of the Economic Development Board, Singapore Customs, Singapore Police and the Civil Aviation Authority of Singapore.

Designed, engineered and financed by a Swiss team, FreePort blends the most rigorous security standards with breathtaking aesthetics. A state-of-the-art facility including strong rooms, basement vaults and a state-of-the-art security system.

FREEPORT is heralding a new era in wealth protection and creation, offering a highly confidential and attractive international free trade zone that makes for the ideal storage premises for precious metals.

Set at Changi airport, amongst the safest areas in the Republic of Singapore, the facility takes delivery of goods directly from the tarmac of Changi airport. The four-storey building has 25,000 square metres of space and is operated as a high security, state-of-the-art duty-free zone.

Gold storage is part of Singapore’s strategy to become the Switzerland of the East. The city-state’s government intends to take its share of global gold storage and trading to 10-15% within a decade, from 2% in 2012. To spur this growth, it has removed a 7% sales tax on precious metals.

FreePort Singapore operations are conducted with the support of the Singapore Customs, the Singapore Police, the Civil Aviation Authority of Singapore, and the Economic Development Board.

Free Trade Zone definition:

Our storage facility within Freeport is a free trade zone where transactions (buying or selling) are tax-exempt and the identity of the beneficial owner is not disclosed.

A free trade zone (FTZ), also sometimes referred to as a “bonded area” is a specific class of special economic zone. They are a geographic area where goods may be landed, handled, manufactured or reconfigured, and re-exported without the intervention of the customs authorities.

Freeport’s are something of a fiscal no-man’s-land. The “free” refers to the suspension of customs duties and taxes. This benefit may have been originally intended as temporary, while goods were in transit, but for much of the stored wealth it is, in effect, permanent, as there is no time limit: bullion or fine art can be flown in from another country and stored for decades without attracting a levy. Better still, sales of goods in FreePort incur no value-added or capital-gains taxes. These are (technically) payable in the destination country when an item leaves this parallel fiscal universe, but by then it may have changed hands several times over.

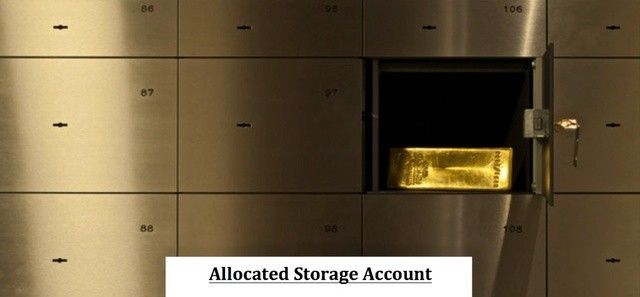

Allocated Bullion Holdings definition:

“Allocated” precious metals are owned outright by the investor and are stored, under a safekeeping or custody arrangement, in a professional vault. It is the sole property of the investor and by law is segregated. “Allocated” holdings differ profoundly from “Unallocated” holdings.

Effectively this means our storage clients are not exposed to any credit or insolvency risks arising from the financial or monetary system.

The Facilities Made Available To Clients

Inspection

Come personally (via appointment only) to inspect your precious metal holdings at our storage facility, or appoint a representative to visit on your behalf. Your holdings can also be photographed (1 photo per bar) on request and serial numbers given as mandatory policy.

.....................................

Collection

Collect your bullion holdings by arranging a pickup from our storage facility within FreePort or by appointing a representative to collect on your behalf.

.....................................

Storage Costs

We offer our customers extremely competitve pricing on vaulted storage, as an example you will effectively be paying 1/4 of one percent on your holdings market value in gold bullion. See here for pricing updates.

.....................................

Transport or Take delivery

Transport your bullion or take delivery by requesting us to arrange the fully insured shipment of your holdings using the world’s pre-eminent logistic agents to selected countries.

.....................................

Transfer Previously Owned Bullion

Transfer bullion that you have purchased from another source into our Freeport storage. Please contact us for details.

.....................................

Sell for cash

Sell your bullion holdings back to us at any time. The proceeds of the sale will be transferred to your bank account, usually within 48 hours.

.....................................

Insurance

Your bullion holdings are fully insured at valuations corresponding directly with present spot market prices of your relevant precious metal holdings by Underwriters at Lloyds of London.

.....................................

Regular Inventory Audits

All allocated bullion holdings undergo regular audits throughout the year.

.....................................

Quarterly Account Statements

We will furnish you with your full bullion listings, inclusive of bar numbers and or bullion coin descriptions and count. Included in this statement will be a present market valuation and storage costs. Note: monthly statements can be given on request.

.....................................

Statutory Financial Audit

Given by an international audit firm with the results of the audit reported annually.

If you wish to read about more about Freeport's generally, a good place to start would be here.

Protect your wealth; invest in physical gold, silver or other precious metals at best prices from Indigo Precious Metals. Physical delivery in Singapore, Malaysia or safe storage at Free port Singapore.