Platinum

-

Low StockOut of Stock

Low StockOut of Stock Out of Stock

Out of Stock Low Stock

Low Stock

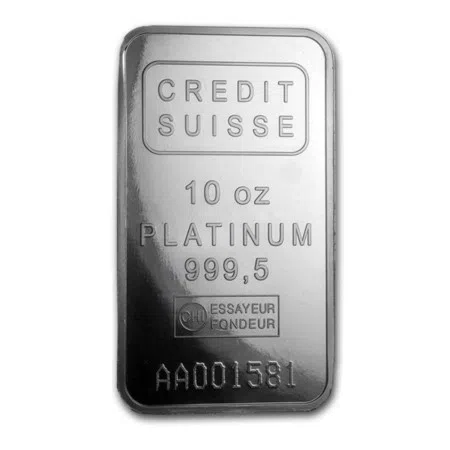

"Collectors Pieces" 10 oz Platinum Bar - Credit Suisse 999.5 Purity, w/Assay

311 gramsFrom ... US$ 10,121.53 Live Prices Low Stock

Low Stock Low Stock

Low Stock One Left

One Left1 Oz Queen's Beast White Horse of Hanover Platinum Coin 2021

31.1 gramsFrom ... US$ 1,080.96 Live Prices

Best PriceOut of Stock

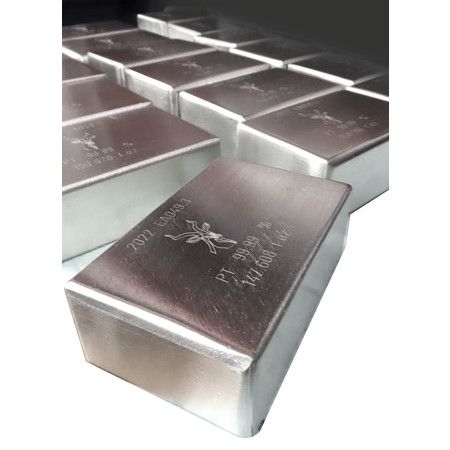

Best PriceOut of StockPlatinum ingot - South Africa LPPM Good Delivery - Various Bar Weights

4.66 KGFrom ... US$ 146,934.49 Live Prices Out of Stock

Out of Stock Best Price

Best Price

Low Stock

Low Stock1 Oz Canada Maple Leaf .9995 Platinum Coin BU Various Years

31.1 gramsFrom ... US$ 1,072.21 Live Prices Best Price

Best Price2022 1 oz South African Platinum Big Five Elephant Coin (BU)

31.1 gramsFrom ... US$ 1,070.63 Live Prices

New

New New

NewIndigo offers a wide range of platinum investment grade bars and coins from around the world. Platinum serves as both a precious metal and as a highly sought-after industrial metal. We offer a wide range of platinum investment grade bars and sovereign coins. Minted bars are available in a wide range of weights from 1 Troy Ounce all the way up to Platinum ingots of 5 kilo in size of the highest grade and purity of 999.5% on request.

All our investment grade bullion is available for secure segregated A-class bonded vaulting in Le Freeport Singapore, or indeed fully insured delivery worldwide using world class logistics, our clients can of course self-collect from our showroom.

Indigo is generally considered one of the markets most price competitive precious metal bullion solution companies and the ranges of platinum bars across different weights from 1 Troy Ounce all the way up to 5 kilo ingots, these include a diverse selection from the world’s best and most highly regarded refineries. Sovereign platinum coins are also offered from the UK Royal Mint and the Perth Mint.

The Platinum Price Is Determined by Both Industrial & Investment Demand

Approximately 83 percent of the world’s Platinum supply is concentrated from mines in northern South Africa (75 per cent of global supply) which is home to the Bushveld Complex, considered to be the largest resource for PGMs in the world, and southern Zimbabwe (8% of global supply). Extraction is not only very expensive but also extremely challenging considering the super-heated magma mines 2 to 3 kilometres deep below the earth’s surface.

Platinum has a silver appearance and is extremely hard. While jewellers value its malleability, it’s also ductile, rigid, dense, and extremely unreactive.

Platinum is first and foremost considered an industrial metal. The greatest yearly demand comes from automotive industry (roughly 40%), which is used predominately in the catalytic to reduce harmful emissions. Further industrial demand (roughly 25%) across many applications from petroleum, chemical refining catalysts, computer industry, fertilisers to pacemakers. Jewellery demand is another 30% of demand, although overall demand curves are changing rapidly.

Platinum ranks as a green metal in the new global clean air and green energy production environment, with Hydrogen’s new growing role leading a very strong charge into platinum demand.

Platinum prices presently are determined in large part by auto sale production numbers. Increasing requirements by pollution legislation is requiring automakers to raise the weightings of platinum, raising demand quickly. With the elevated prices of Palladium, substitution demand into Platinum is also occurring.

IPM Group is expecting dynamic platinum price appreciation over the next few years.

Talk To Us

Talk To Us